About corrections

Corrections are essential to maintain accurate records of incurred costs and compliance with organizational policies, labor laws, and financial regulations.

As a program office user, you might want to request timesheet corrections if you find errors in recorded hours, incorrect cost center allocations, or other missing entries. Similarly, expense records might require corrections if an expense was categorized incorrectly, or an amount needs to be updated.

Timesheet corrections

Hiring managers and program office users can amend worker engagements in Beeline Professional to update cost center allocations, engagement rates, or other financial details. When these changes affect submitted timesheets, the system generates a critical timesheet notification to alert users that updates are required. The notification appears as a note directly on the affected timesheet and provides clear, actionable steps for resolving the issue.

When a retroactive engagement update changes a cost center or other financial field, previously submitted timesheets may contain outdated values. In these cases, workers or suppliers must review the impacted timesheets and select the correct values. Workers and suppliers can initiate corrections in the Talent Experience and Supplier Network apps respectively. Only timesheets with Approved and Invoiced status can be corrected.

| If an engagement includes only one cost center or financial field and that single value is retroactively changed to another single value, no user action is required. The system automatically applies the new value to the timesheet, and no critical timesheet notification is generated. |

All corrected timesheets retain the same ID number and include an additional suffix to indicate the entry was corrected.

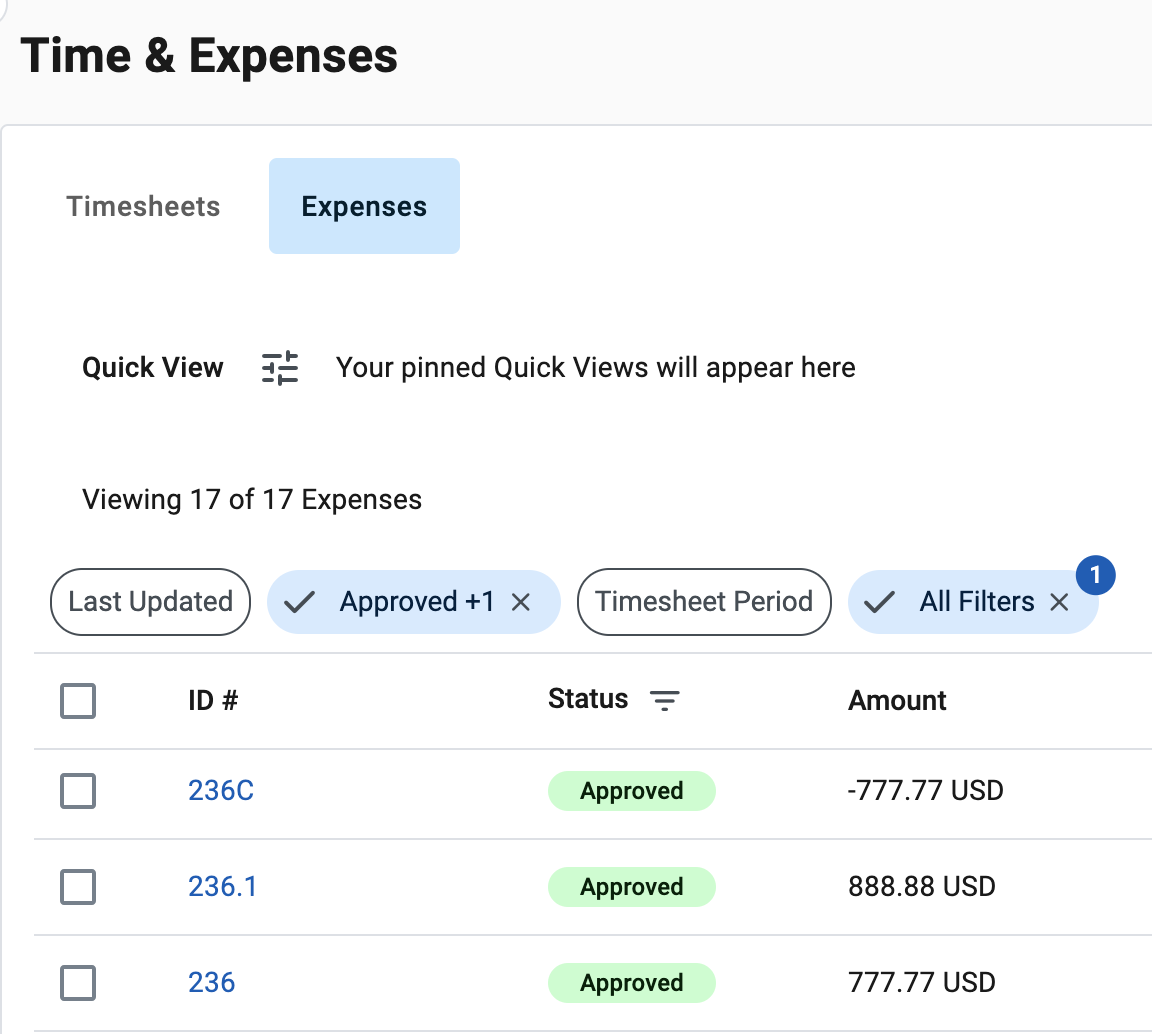

For example, when timesheet 1340 is corrected, 2 new entries are added in the Timesheets tab of the Time & Expenses hub:

-

A timesheet with ID

1340.1, which represents the timesheet with updated values. -

A timesheet with the ID

1340Cwhich represents the correction amount. The correction amount is the inverse amount specified on the initial1340timesheet.

Expense corrections

Adjusting expenses involves correcting amounts, dates, or categories entered during submission.

Expenses with the Approved and Invoiced status can be corrected by:

-

Workers in the Talent Experience app

-

Suppliers in the Supplier Network app

-

Program office users in Professional. For more information, see Correcting expense records.

All corrected expenses retain the same ID number and include an additional suffix to indicate the entry was corrected.

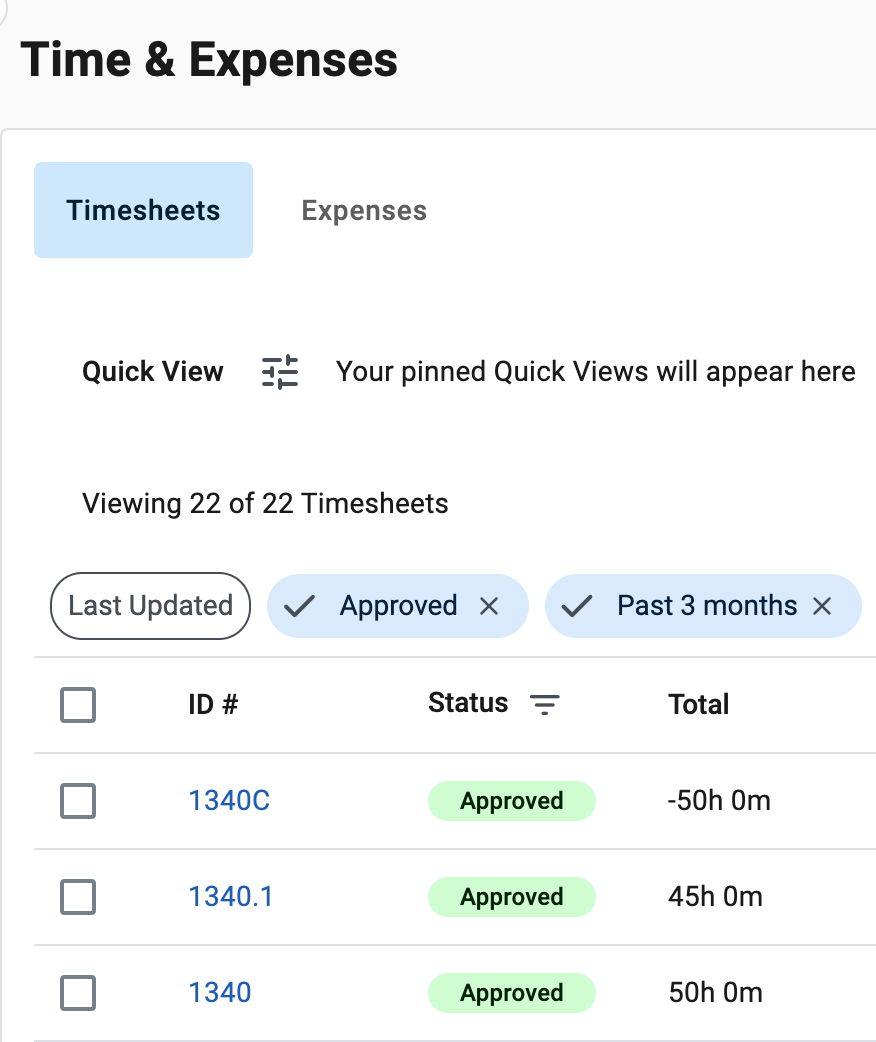

For example, when expense 236 is corrected, 2 new entries are added in the Expenses tab of the Time & Expenses hub:

-

An expense item with ID

236.1, which represents the expense with updated values. -

An expense item with the ID

236Cwhich represents the correction amount. The correction amount is the inverse amount specified on the initial 236 expense.