About engagement budgets

Budgets help organizations adjust their financial plans proactively by tracking how allocated funds are spent. With a clear understanding of how much budget is spent per worker engagement, hiring managers or program office users can allocate resources more efficiently, supporting better decision-making.

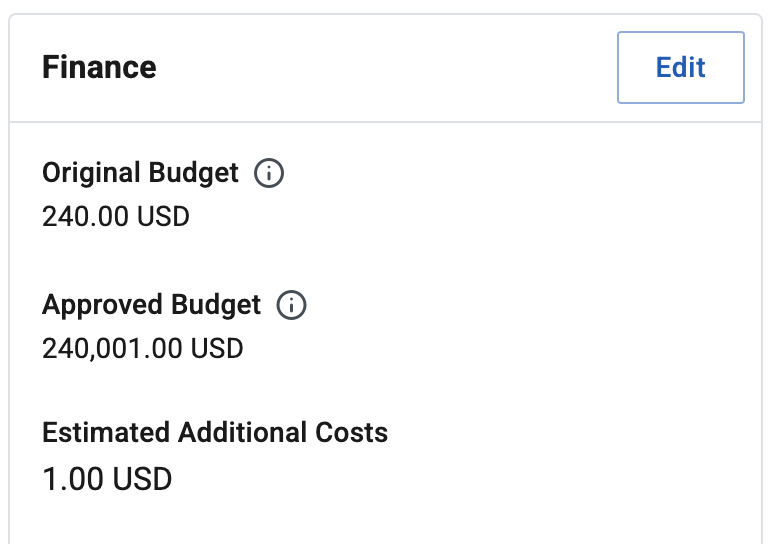

These budget-related fields display in the Finance tab of an engagement:

-

Original Budget

-

Approved Budget

-

Estimated Additional Cost

The Original Budget represents the amount originally agreed upon between the hiring manager and supplier when an offer is accepted. This value will never change.

The Approved Budget represents the current calculated amount that includes any rate, engagement duration, work schedule, or holiday schedule changes that might have altered the original budget. Hiring managers and program office users can use this value to estimate the impact that engagement changes have when compared to the original budget.

The Estimated Additional Costs represents an amount included in the approved budget calculation to account for any additional expenses, such as overtime, travel, or other contingencies. Hiring managers or program office users can modify this amount by amending the engagement.

How are engagement budgets calculated in Beeline Professional?

Engagement budgets are calculated considering these factors:

-

The engagement duration

-

The work schedule

-

The holiday schedule

-

The bill rate

-

Any applicable taxes and fees

-

Estimated additional costs.

Sample calculation

To calculate the original budget value for an engagement, the system determines the number of working hours for the engagement duration period and multiplies that number by the bill rate. Assuming rate cards are configured for fee and tax values, they also get calculated and added to the budget value.

| Factors affecting budget calculations | Values |

|---|---|

Engagement duration |

From Jan 1st until Jan 31st, 2025 |

Work schedule |

5 days per week with 8 working hours per day |

Holiday schedule |

2 holidays during the engagement duration |

Bill rate |

|

MSP fee |

.02 |

Tax |

.01 |

Additional estimated costs |

$1000 |

Working days for the duration of the engagement = (Engagement start date until end date) - (Number of holidays defined in the holiday schedule)

(23 working days) - (2 holidays) = 21 working days

Total working hours for the duration of the engagement = (Working days for the duration of the engagement) * (Number of working hours per day as defined in the work schedule)

(21 working days) * (8hrs per day) = 168 total working hours

Original budget = (Total working hours for the duration of the engagement) * (Bill rate)

(168 total working hours) * ($100) = $16,800

Original budget with additional estimated costs, taxes, and fees = (Original budget) + (Additional estimated costs) + (Original budget * Fees) + (Original budget * Taxes)

($16,800 original budget) * (.02 MSP Fee) = $336

($16,800 original budget) * (.01 Tax) = $168

($16,800 original budget) + ($1000 additional estimated costs) + ($336 MSP Fees + $168 Taxes) = $18,304