About taxes and fees

In the world of contingent staffing, program fees play a crucial role in the overall cost structure and pricing strategies for businesses utilizing temporary or contract workers. While best practice recommends that suppliers are responsible for managing engagement-related taxes, they can also be managed and applied in Beeline Professional for each engagement.

Taxes and fees are special rates that automatically add extra amounts to invoices and exports for timesheets and expenses. You configure a tax or fee by setting up a rate with special properties so that when timesheets and expenses are invoiced, the system accounts for the extra amount based on other rates they are connected to.

There is no distinction between how a tax and a fee function, however, the amounts they each represent are stored separate.

Setting up a tax or fee

Taxes and fees are set up in the tab and process is similar to setting up rates.

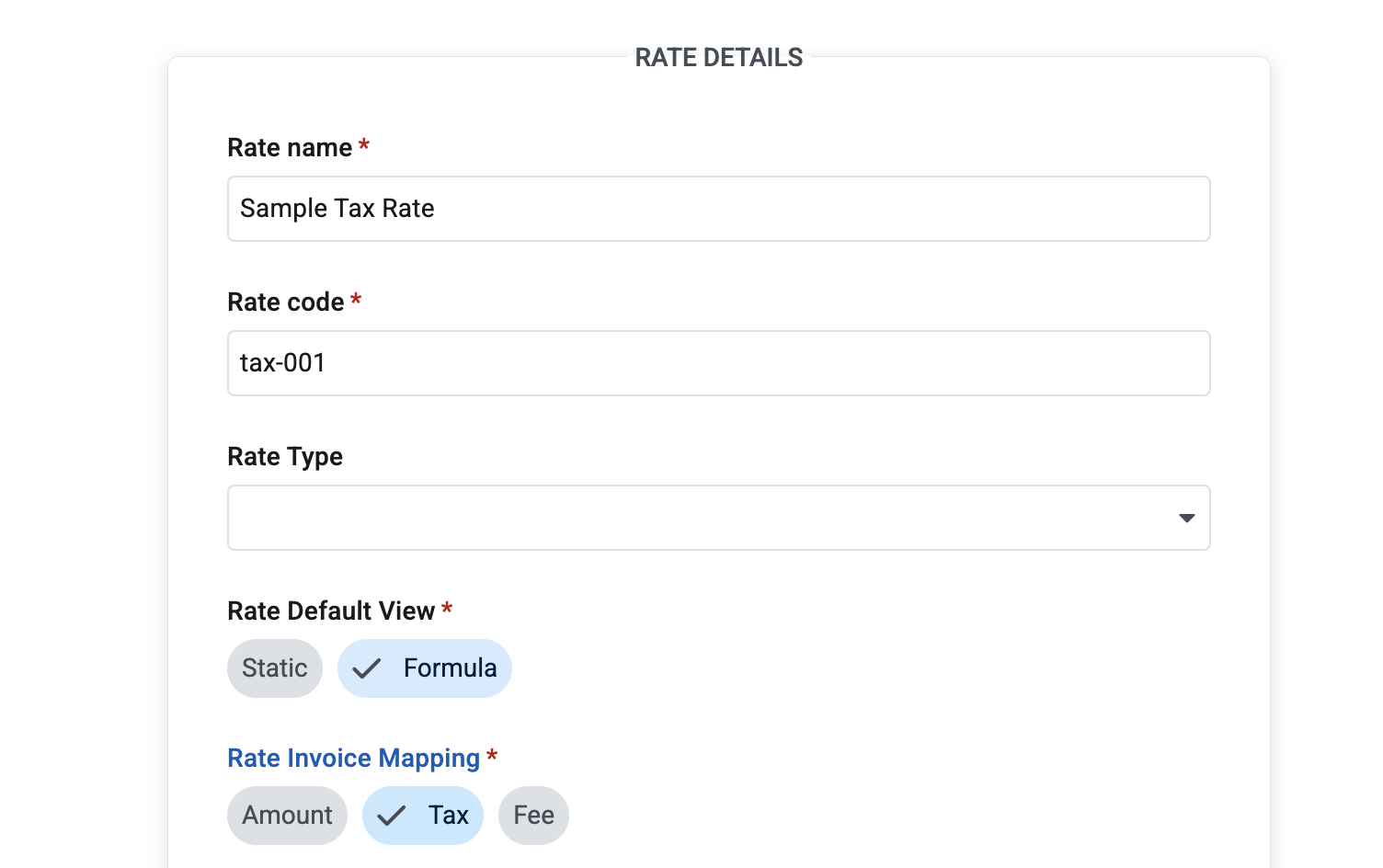

When defining a new rate, classify the rate as a tax or fee by selecting the appropriate Rate Invoice Mapping label. For more information, see Defining rates.

To ensure that a tax or fee rate is used correctly, confirm that these conditions are satisfied:

-

The Rate Default View is set to Formula.

-

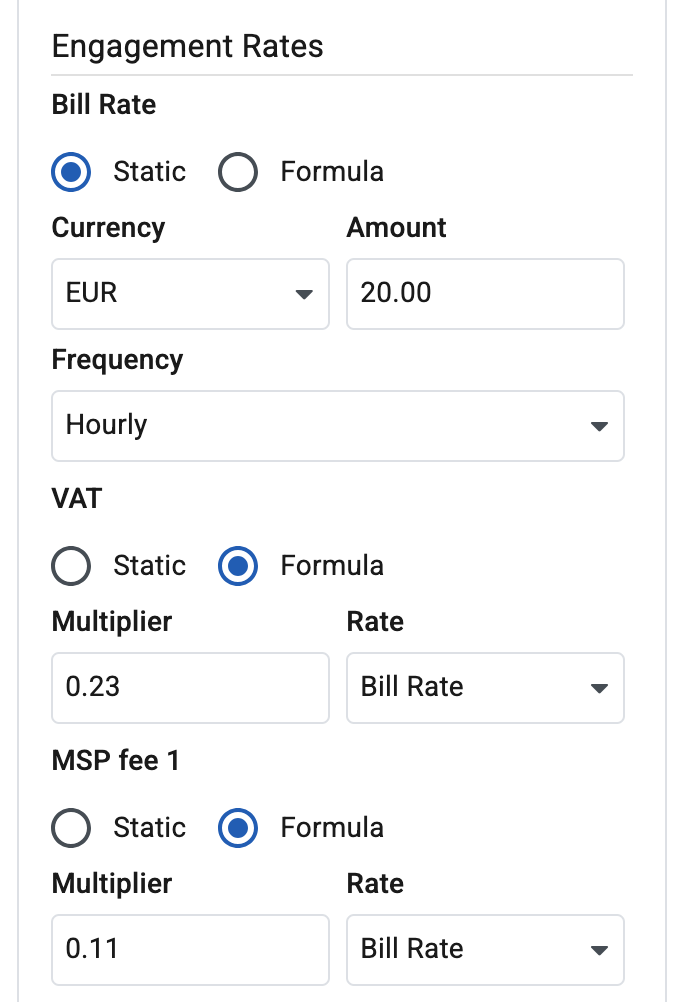

On the worker’s Engagement, the value of the rate is set to the percentage you want expressed as a decimal.

For example, use the

0.5value if you want to set it to 50%. -

The base rate of the tax or fee is set to the rate you want to use in timesheets. Usually it is set to the bill rate.

Figure 2. Engagement rate setup

Figure 2. Engagement rate setup

How taxes and fees are used in Beeline Professional

Taxes and fees are only used as part of the timesheet solution.

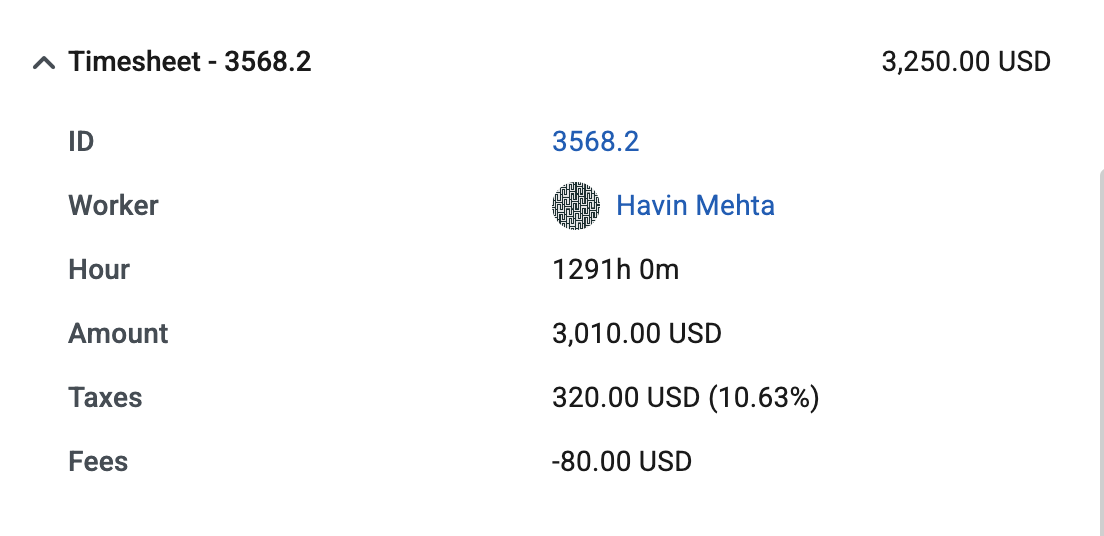

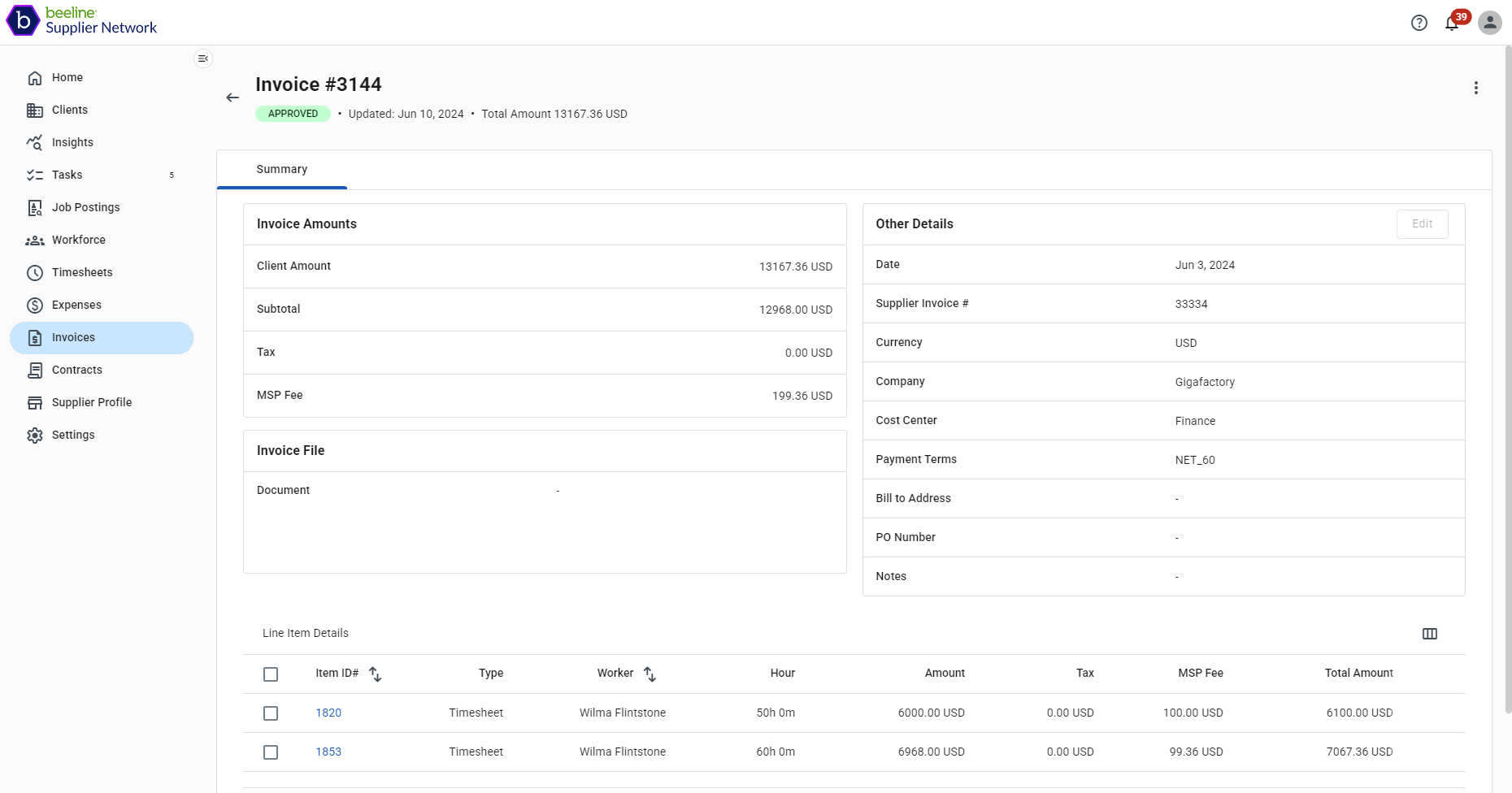

When a rate is used in a timesheet, the timesheet engine checks if there are any taxes and fee rates connected to that rate for the current engagement. If there are, it calculates the amount of taxes and fees for that allocation and stores it in the timesheet. Taxes and fees are not displayed on the timesheet, however they are available in the Timesheet Export report before invoicing. After the timesheet is added to an invoice, taxes and fees are available in the invoice details, when viewing the invoice in the Invoices hub.